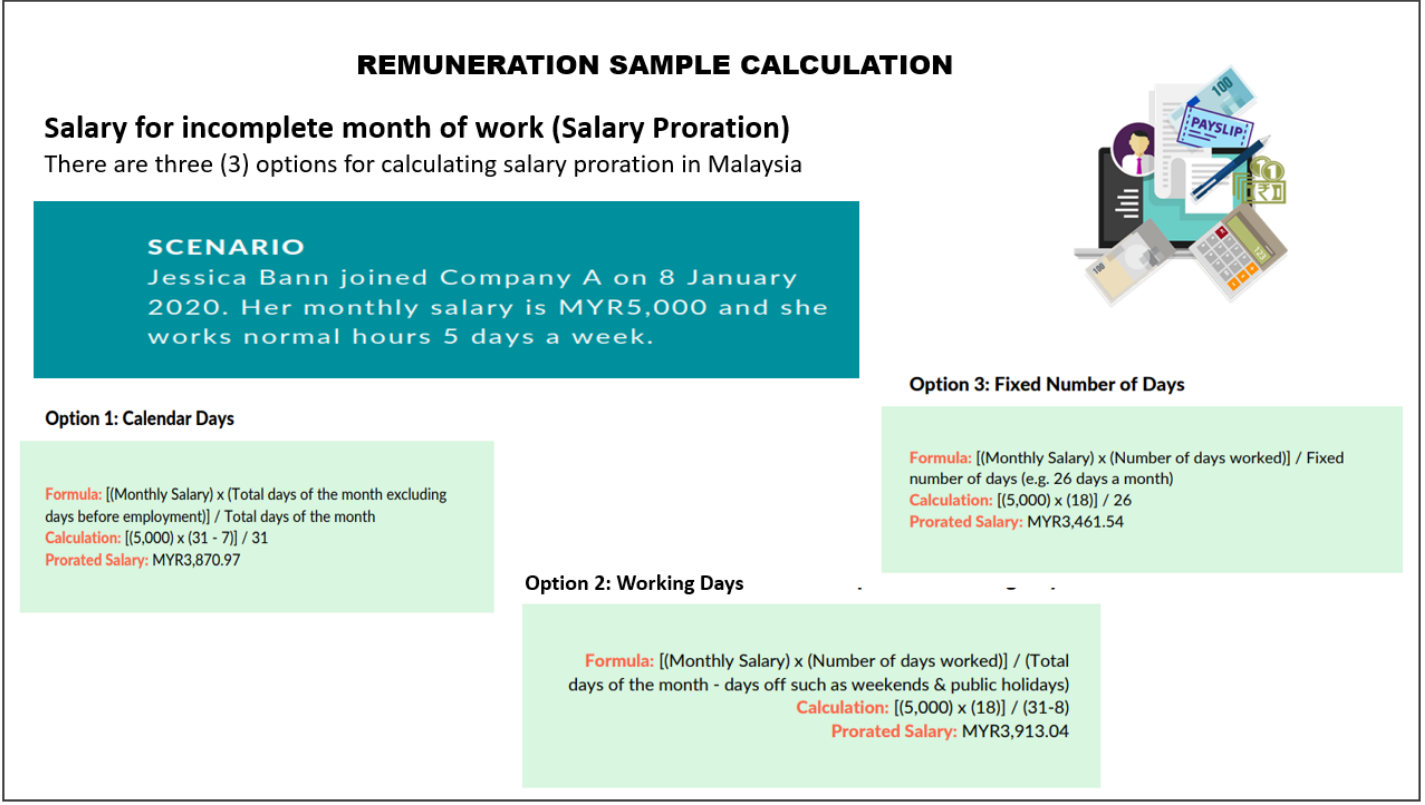

If the employer wants or needs the employee to leave immediately they will have to make a payment in lieu of notice of RM20000 to the employee. Paid based on the number of days worked from home.

Get Our Sample Of Commission Payment Voucher Template For Free Templates Excel Templates Slip

When an employee has to work on a public holiday and the hours follow normal working hours heshe should be paid a 2-day wage at an ordinary rate of pay.

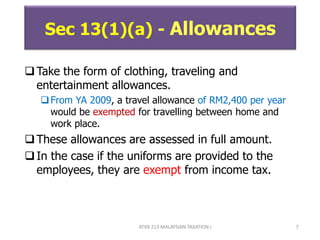

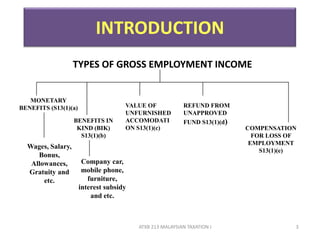

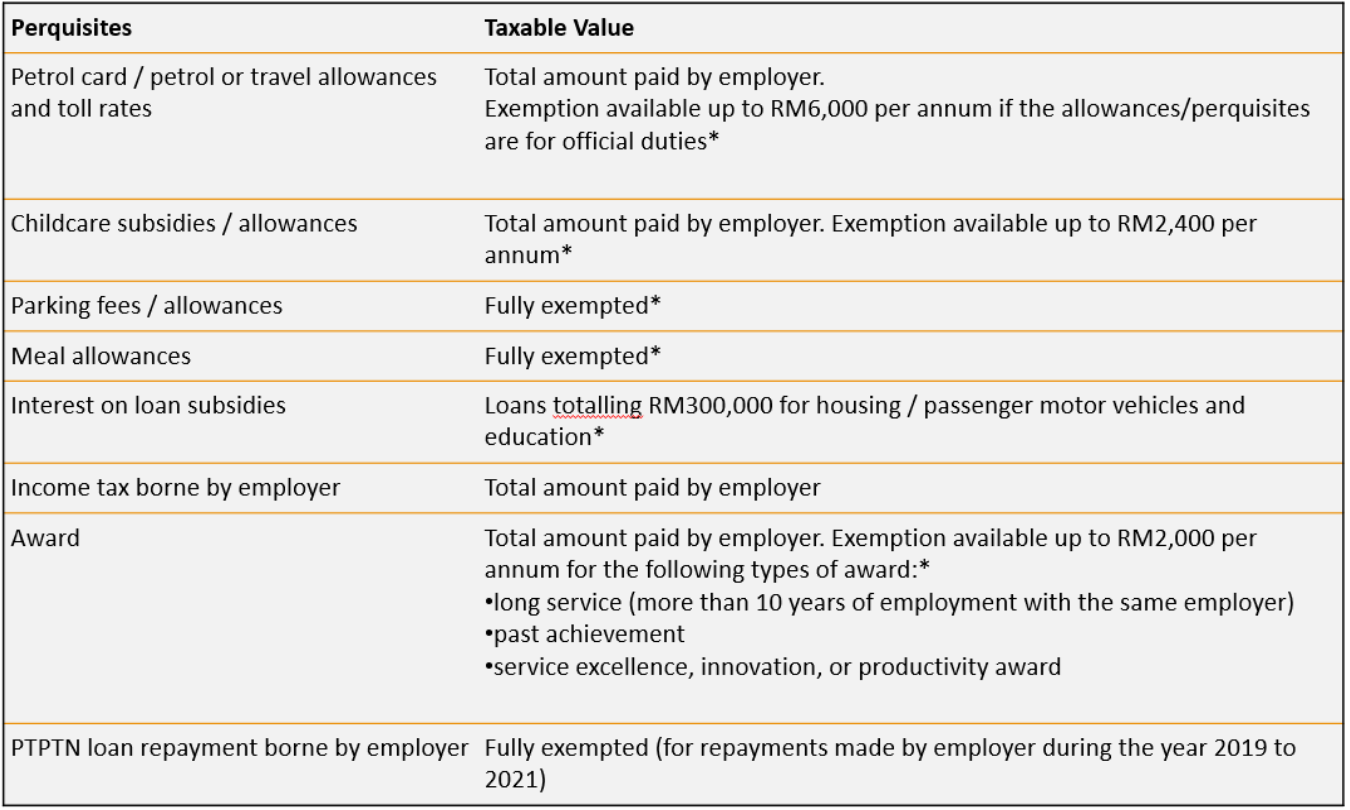

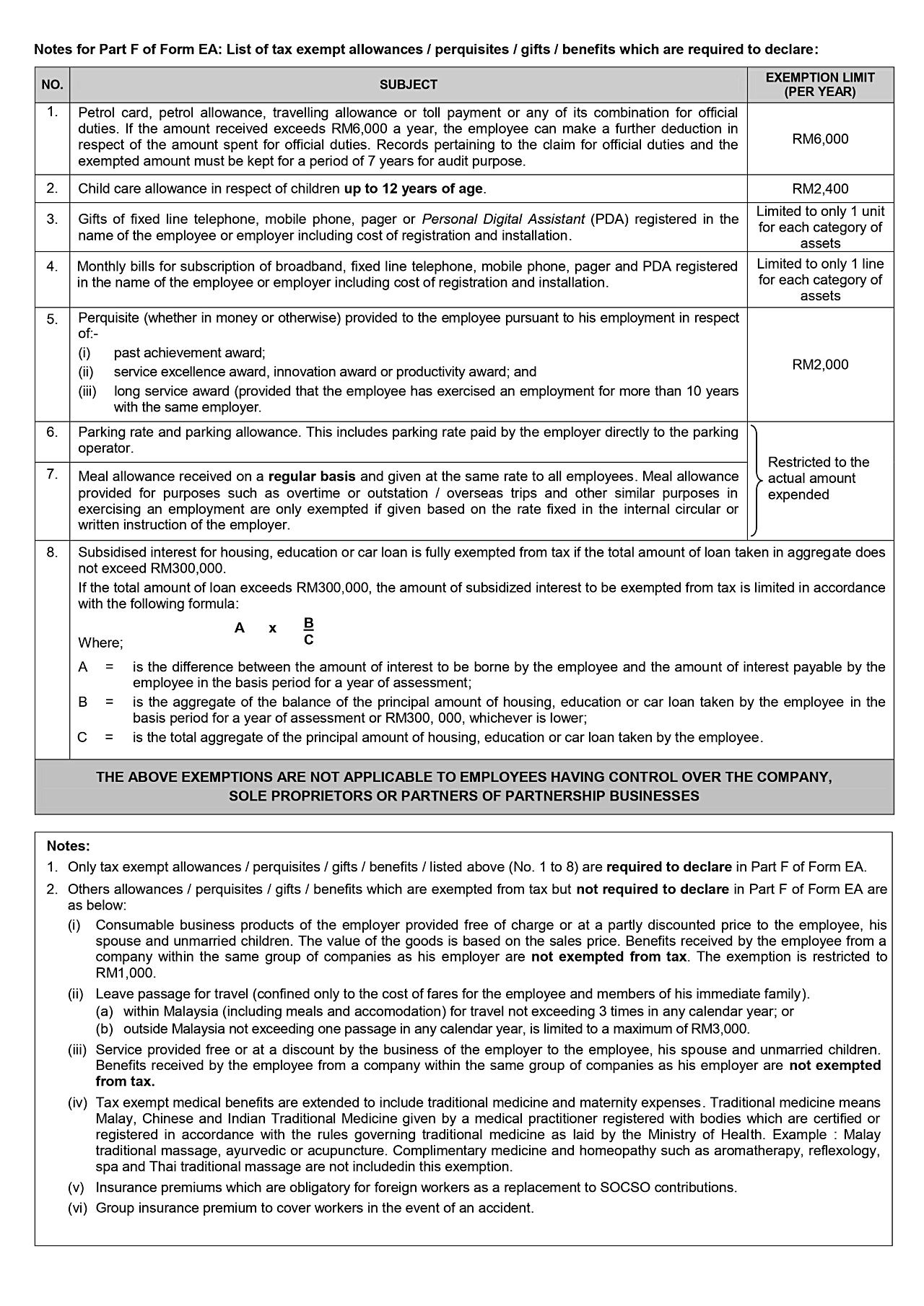

. Total amount paid by employer. However depending on the type of allowance some LHDN tax deductions apply and you can meet the expectations of senior management and employees. Is Allowance Taxable in Malaysia.

Petrol card petrol or travel allowances and toll rates. Employees with five or more years of service get 16 days off for each year. Job search allowance early re-employment allowance reduced income.

Parking allowance Meal allowance Child care allowance of up to RM2400 annually Subsidies on interest for housing education car loans Full exemption if up to RM300000 loan Allowance for monthly bills for fixed line telephone mobile phone tablet broadband subscription only one line for each category. Leave Travel Allowance LTA. The Employment Act 1955 is the main legislation on labour matters in Malaysia.

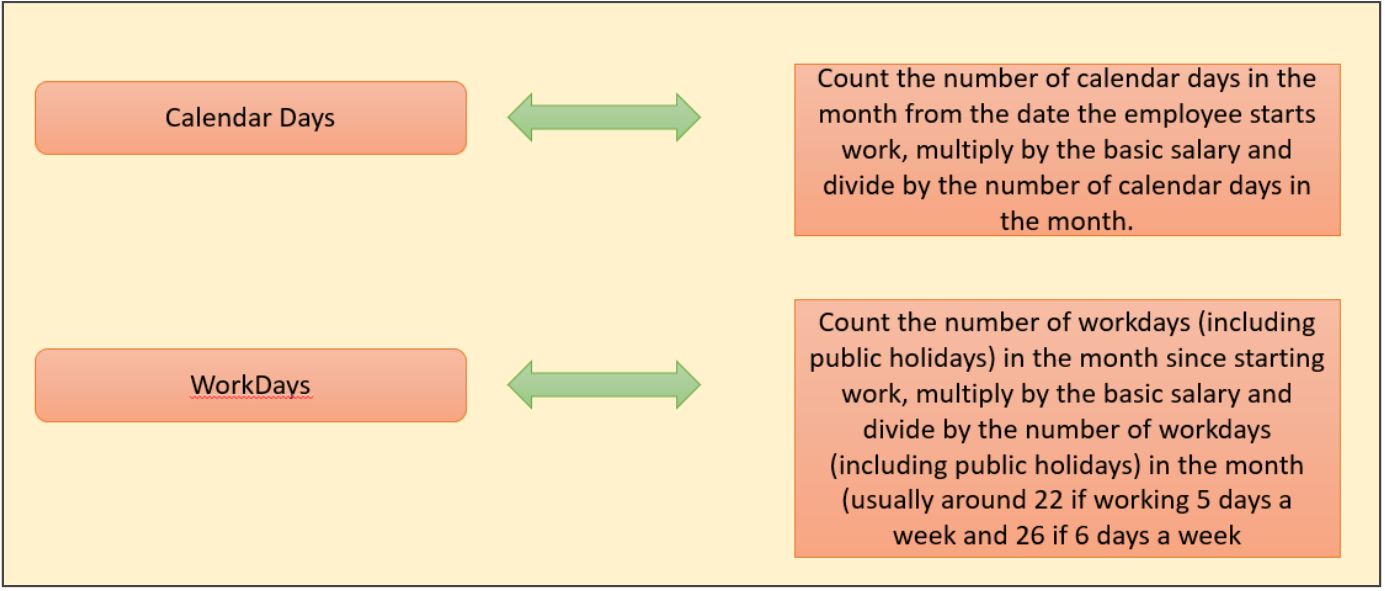

Employees shall be granted 13 vacation days on a prorated basis for less than 2 years. Travel. All amounts paid to a natural person in.

2022 MALAYSIA BENEFITS SUMMARY. Employees engaged in the operation or maintenance of mechanically propelled vehicle. For example the employee would get 8 days of annual leave for every 12 months of service continually with the same employer.

A worker does not work continuously like a machine and hence personal allowance is provided to him in order to satisfy his personal requirements like drinking water taking tea visiting toilet and trip to dressing room etc. Tuesday 01 Aug 2017 114 PM MYT. Public Holidays Overtime Rates.

Includes payment by the employer directly to the parking operator. Any employee employed in manual work including artisan apprentice. This will be provided to those in positions that require landline telephone service.

Exemption available up to RM2400 per annum Parking fees allowances. Any employee as long as his month wages is less than RM200000 and. Tax exempt up to RM2400 per year.

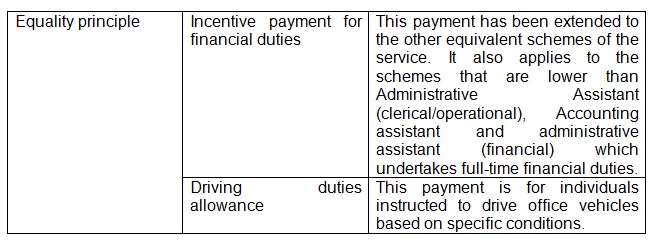

Vs Aloysies Fathianathan The employee alleged that he had been employed by the company as a Director with a basic salary of RM2000 and a fixed monthly allowance of RM5000 altogether totalling RM7000. All employees are covered by Malaysias universal healthcare system which is funded through both employee and employer taxes. An allowance paid to employees during the period said employee is acting on additional or different roles.

Parking rate or parking allowance. Total amount paid by employer. The Act states that overtime hours during the week on a working day are paid at 15000 of the regular salary rate and overtime hours worked on rest days and weekends are paid at 20000 of the regular salary rate.

Payment for overtime worked on public holidays is paid at a rate of 30000 of the regular salary rate. Includes payment by the employer directly to the childcare provider. Content of Allowance Claim Limit per Month Description.

He claimed that the company failed to provide him his balance wages of RM4000 for the month of April and wrote to the company. It is offered for an employee for travelling anywhere in India for the company purpose. For example employees with fewer than two years of service get eight days of vacation for each year worked.

Fully exempted Meal allowances. The same would apply in the inverse situation where an employee wishes to leave ahead of their notice period. Family benefits company doctor driver or security.

Tax exempt as long the amount is not unreasonable. 2 x hourly rate of pay x the number of hours in excess of 8 hours 1 full days wage at the ordinary rate of pay. The Employment Act provides minimum terms and conditions mostly of monetary value to certain category of workers -.

Free lunch meal or dinner. Allowances to Non-Executive Directors for attending during the AGM or EGM. HRA is to meet the accommodation expenses of the employee.

Petrol allowance petrol card travelling allowance or toll payment or any combination. Female workers also get no less than 60 consecutive days of. Annual leave Annual leaves in Malaysia are calculated based on the days of service by the employee.

Exemption available up to RM6000 per annum if the allowancesperquisites are for official duties Childcare subsidies allowances. It is partially exempt us 10 13A and the remaining amount is taxable. The general working conditions and the.

Employees whose monthly salary does not exceed RM2000. Type of allowance for employees in malaysia. Employees who are engaged in manual labour regardless of salary.

This time is allowed for physical needs of the worker. Employees are eligible for most benefits programs on the first day of employment. Employees who supervise or oversees other employees engaged in manual labour.

The company can only provide a part of the fare and the balance. The binding employment contract stipulates a notice period of two months. Example of allowances commonly paid in Malaysia Travel allowance prerequisite Meal allowance prerequisite Phone allowance prerequisite Acting allowance taxable.

This is provided if you have a home internet subscription. House Rent Allowance HRA. Meal allowance is paid according to the position duties or place where the employment is performed by the employee.

Uniforms. Public holidays Employees are entitled to paid public holidays here in Malaysia. The Types of General Employees Remuneration.

If you require that your staff works on a public holiday then. KUALA LUMPUR Aug 1 The government has listed four types of allowances for retrenched workers under the newly proposed Employment Insurance Scheme EIS hoped to take effect beginning January 1 next year.

Get Our Sample Of Commission Payment Voucher Template For Free Templates Excel Templates Slip

Everything You Need To Know About Running Payroll In Malaysia

Everything You Need To Know About Running Payroll In Malaysia

Everything You Need To Know About Running Payroll In Malaysia

How To Create A Free Payslip Template In Excel Pdf Word Format How To Wiki Payroll Template Receipt Template Templates

List Of Tax Deduction For Businesses Cheng Co Group

Everything You Need To Know About Running Payroll In Malaysia

.jpg)

Importance Of Issuing A Payslip In Malaysia Insights Propay Partners

Official Portal Public Service Department Jpa

Everything You Need To Know About Running Payroll In Malaysia

Hiring Remote Workers In Germany A Guide For Us Employers

Covid 19 The Enhanced Wage Subsidy Programme Bdo

Reducing Salary Allowances And Bonuses For Disciplined Employees Is It Allowable Le Tran

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Monthly Tax Deduction 2 Social Security Organization 3 Employee Provident Plan Skachat Besplatno I Bez Registracii

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers